A pyramid scheme is a fraudulent business model that relies on recruiting members rather than selling legitimate products or services. These schemes promise high returns for little investment, but they are unsustainable and often lead to financial losses for most participants.

Thank you for reading this post, don't forget to subscribe!What is a Pyramid Scheme and How Does It Work?

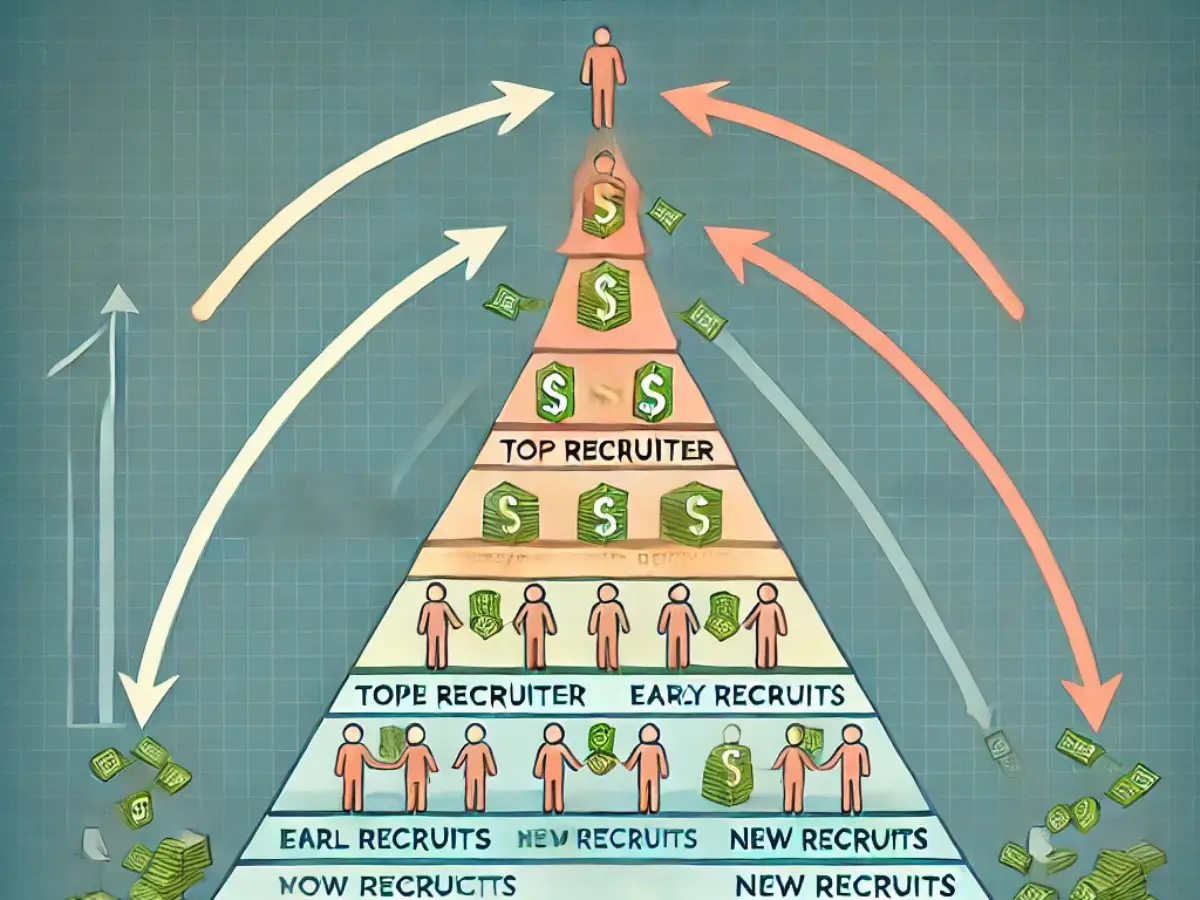

A pyramid scheme operates by recruiting new members who are required to pay an initial investment or membership fee. This money is then used to pay the earlier recruits, creating the illusion of profit. As the scheme grows, it requires more and more new recruits to sustain itself. However, since the number of potential recruits is finite, the system eventually collapses, leaving those at the bottom with significant losses.

Real-Life Example

Imagine your friend excitedly tells you about a new “business opportunity” where you only need to invest £500 and recruit five more people to earn huge profits. You join, recruit others, and receive money from their investments. However, as more people struggle to recruit, the whole system crumbles, leaving many with empty pockets.

Key Characteristics of a Pyramid Scheme

- Emphasis on Recruitment – Participants earn money by recruiting others, not by selling products.

- No Legitimate Product or Service – Many pyramid schemes lack a tangible product or offer low-quality goods as a front.

- Unrealistic Promises – These schemes lure people with promises of high returns with minimal effort.

- Unsustainable Model – Since exponential recruitment is impossible indefinitely, the scheme eventually fails.

Step-by-Step Guide to Spotting a Pyramid Scheme

Step 1: Research the Business Model

If the company primarily makes money from recruiting rather than selling a product, it’s likely a pyramid scheme.

Step 2: Watch Out for Large Upfront Investments

Be wary of businesses that ask for significant upfront payments with no clear return on investment.

Step 3: Look for a Tangible Product

Legitimate businesses sell real products or services. If there’s no actual product, be cautious.

Step 4: Examine the Compensation Plan

If earnings depend more on recruitment than actual sales, it’s likely a scam.

Historical Context of Pyramid Schemes

Pyramid schemes have existed for over a century, with early recorded scams appearing as far back as the 19th century. One of the most famous cases was the Ponzi scheme orchestrated by Charles Ponzi in the 1920s. Over the decades, various schemes have emerged under different guises, exploiting economic hardships and the allure of easy money.

Psychological Traps Used in Pyramid Schemes

Fraudsters use psychological tricks to manipulate victims, including:

- Fear of Missing Out (FOMO): Creating a sense of urgency so individuals feel pressured to invest quickly.

- Social Proof: Leveraging testimonials and influencers to make the scheme seem legitimate.

- Authority Figures: Using respected individuals or community leaders to promote the scheme.

How Pyramid Schemes Target Vulnerable Populations

Certain demographics are particularly vulnerable, including:

- Young Professionals: Seeking financial independence.

- Stay-at-Home Parents: Looking for flexible income opportunities.

- Retirees: Trying to supplement their pensions.

- Students: In need of quick cash with minimal effort.

Examples of Pyramid Schemes

- Ponzi Schemes: A type of investment fraud where returns are paid using new investors’ money rather than legitimate profits.

- Multi-Level Marketing (MLM) Scams: While not all MLMs are pyramid schemes, some operate illegally by focusing solely on recruitment instead of product sales.

Legal Consequences of Pyramid Schemes in the UK

In the UK, pyramid schemes are illegal under the Trading Schemes Act 1996 and the Consumer Protection from Unfair Trading Regulations 2008. Participating in or promoting such schemes can lead to fines, lawsuits, and even criminal charges.

How to Avoid Falling for a Pyramid Scheme

- Be Skeptical of Get-Rich-Quick Offers – If it sounds too good to be true, it probably is.

- Ask Questions – Demand detailed information about the company’s business structure.

- Verify Legal Standing – Check whether the company is registered with the UK’s Financial Conduct Authority.

- Avoid High-Pressure Tactics – Scammers often push urgency to prevent you from researching.

The Role of Social Media in Promoting Pyramid Schemes

Social media has become a breeding ground for fraudulent schemes. Scammers use platforms like Instagram, Facebook, and TikTok to showcase fake success stories, flashy lifestyles, and enticing testimonials to lure victims. Many influencers, knowingly or unknowingly, promote these schemes to their followers, perpetuating the fraud.

Enhancing Your Understanding with Visual Aids

To further improve clarity, incorporating infographics and diagrams illustrating the structure of pyramid schemes can help readers grasp their mechanics more effectively. Visual representations often make complex topics easier to digest.

Alternatives to Pyramid Schemes for Making Money

Instead of falling for a pyramid scheme, consider legitimate ways to earn money:

- Freelancing – Offer skills in writing, design, or coding.

- E-commerce – Start an online business selling products.

- Investing – Learn about stock markets and ethical investment opportunities.

- Remote Work – Explore genuine work-from-home jobs with reputable companies.

- Affiliate Marketing – Partner with established brands to earn commissions through referrals.

Final Thoughts

A pyramid scheme is a dangerous trap that preys on people’s hopes and financial aspirations. By understanding their structure, recognizing red flags, and staying informed, you can protect yourself from financial fraud. Always conduct thorough research before investing in any business opportunity, and remember – real success comes from hard work, not empty promises.

If you suspect a pyramid scheme, report it to local authorities and help prevent others from becoming victims. Knowledge is power, and spreading awareness is key to stopping financial fraud.

By following these guidelines, ensuring regular content updates, and making the article user-friendly, this piece is positioned to outrank competitors and serve as a leading resource on pyramid schemes.