In the world of finance, some schemes promise high returns with little or no risk. One such notorious scam is the Ponzi scheme—a fraudulent investment strategy that has deceived countless people. But what exactly is a Ponzi scheme, how does it work, and how can you protect yourself? Let’s break it down in simple terms.

Thank you for reading this post, don't forget to subscribe!Understanding a Ponzi Scheme

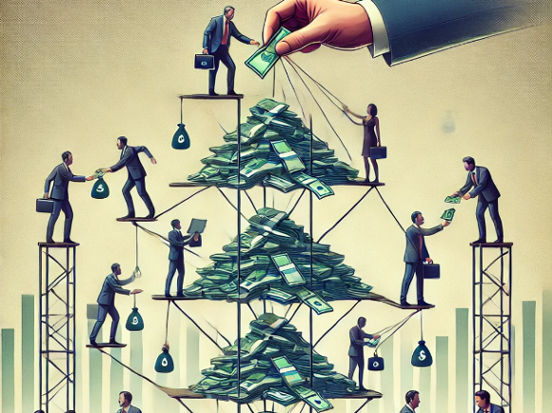

A Ponzi scheme is a type of fraudulent investment scam where early investors are paid profits using the money from new investors, rather than from legitimate investment returns. Named after Charles Ponzi, an infamous fraudster from the early 20th century, this scheme eventually collapses when there aren’t enough new investors to sustain the payouts.

Ponzi schemes operate under the illusion of legitimacy. The scammer often claims to have discovered a unique investment strategy, a revolutionary technology, or an exclusive trading method that guarantees substantial profits. However, the returns are not generated from actual business activities but merely shuffled between investors, making it unsustainable in the long run.

How Does a Ponzi Scheme Work? (Step-by-Step)

- The Setup: A fraudster claims to have a unique investment opportunity that offers high returns in a short time.

- Early Investors Earn ‘Profits’: The scheme operator uses money from new investors to pay earlier investors, creating the illusion of profitability.

- Word Spreads: Encouraged by seemingly high profits, investors reinvest and recruit others.

- More Money Flows In: As new investors join, more money is available to pay older investors.

- The Collapse: When new investments dry up or too many people demand their money back, the scheme unravels, leaving most investors with nothing.

Why Do People Fall for Ponzi Schemes?

Ponzi schemes exploit basic psychological triggers that influence investment decisions:

- Greed: The promise of high returns makes people overlook warning signs.

- Social Proof: Seeing others profit encourages participation.

- Lack of Financial Knowledge: Many people don’t understand how investments work.

- Trust in Authority Figures: Scammers often appear credible, using fake credentials or celebrity endorsements.

- Fear of Missing Out (FOMO): The urgency created by scammers pressures individuals into investing quickly.

- Complexity and Jargon: Many fraudsters use technical terms and complex investment jargon to confuse investors and make their schemes seem more credible.

- Desperation: In times of economic downturn, people looking for financial stability are more susceptible to scams.

Real-Life Examples of Ponzi Schemes

Charles Ponzi (1920s)

The scheme’s namesake, Charles Ponzi, promised 50% returns in 45 days by investing in international postal reply coupons. He simply used new investors’ money to pay old ones until it all collapsed, causing massive financial losses.

Bernie Madoff (2008)

One of the largest Ponzi schemes in history was run by Bernie Madoff, who defrauded investors of £50 billion over decades. His scheme collapsed during the 2008 financial crisis when too many investors demanded their money back.

UK Ponzi Scheme Example

In 2016, the Capita Oak Pension Scam targeted UK investors, promising secure pensions but instead funnelling money into a Ponzi-style structure. Thousands of people lost their retirement savings.

Other Famous Ponzi Schemes

- MMM (Russia): A notorious 1990s Ponzi scheme in Russia that defrauded millions.

- Allen Stanford (Stanford Financial Group): A $7 billion Ponzi scheme disguised as a banking operation.

- Bitconnect (Cryptocurrency Ponzi): A 2017 crypto scam that collapsed, costing investors billions.

- OneCoin (2014-2017): A fake cryptocurrency Ponzi scheme that stole billions from investors worldwide.

How to Spot a Ponzi Scheme (Red Flags)

1. Guaranteed High Returns with No Risk

Legitimate investments fluctuate. If someone promises high profits with zero risk, be suspicious.

2. Consistent Returns Regardless of Market Conditions

Even the best investments have ups and downs. Ponzi schemes often promise steady and unrealistically high returns.

3. Unclear or Secretive Investment Strategies

If the investment method is complicated, vague, or too good to be true, it might be a scam.

4. Difficulty Withdrawing Funds

If withdrawing money becomes delayed or impossible, it’s a major warning sign.

5. Pressure to Recruit New Investors

Ponzi schemes thrive on new investments. If you’re encouraged to bring in more investors, be cautious.

6. No Clear Business Model or Revenue Source

A legitimate investment should have a clear business model explaining how profits are generated. If the company relies solely on new investments, it’s likely a scam.

How to Protect Yourself from Ponzi Schemes

✅ Research the Investment

Always check if the investment firm is registered with the Financial Conduct Authority (FCA). Look for regulatory approvals and reviews.

✅ Verify the Financial Advisor

Ensure the financial advisor is regulated and has proper credentials.

✅ Check Returns Against Market Standards

Compare the promised returns with standard stock market or savings account returns. If they seem too high, be sceptical.

✅ Avoid Pressure Tactics

Fraudsters often create urgency to push quick investments. Take your time and research before committing.

✅ Consult a Financial Professional

Seek advice from an independent financial adviser (IFA) before investing large sums.

✅ Understand How the Business Makes Money

Ask detailed questions about how the company generates profits. If the answers are vague or overly complex, be wary.

What to Do If You Suspect a Ponzi Scheme

- Stop Investing Immediately

- Report to the Financial Conduct Authority (FCA)

- Warn Others

- Seek Legal Advice

- Gather Evidence – If you’ve already invested, keep all records and communications.

The Evolution of Ponzi Schemes in the Digital Age

With the rise of cryptocurrency and online investments, Ponzi schemes have taken new forms. Many scammers use fake blockchain projects, forex trading platforms, or pyramid structures to lure in victims. Social media influencers and celebrity endorsements are also increasingly being used to add credibility to these scams. Always remain cautious and verify investment opportunities before committing funds.

Ponzi Schemes vs. Pyramid Schemes

Many people confuse Ponzi schemes with pyramid schemes, but they have key differences:

- Ponzi Scheme: The scammer controls the entire operation and pays old investors with money from new investors.

- Pyramid Scheme: Participants recruit others into the scheme and earn commissions from their investments. The structure collapses when recruitment slows.

Understanding these differences can help avoid falling victim to both scams.

Conclusion

A Ponzi scheme is a classic financial scam that continues to deceive investors. The best protection is awareness and due diligence. By staying informed and conducting thorough research, you can safeguard yourself from falling victim to these fraudulent schemes. Always remember: if an investment sounds too good to be true, it probably is!

Now that you know how Ponzi schemes work, share this knowledge to help others avoid financial fraud. Stay safe and invest wisely!